The amount of under-absorption is added to the cost of items created and sold if the actual output level is less than the normal output level. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Introduction to Absorption Costing in Accounting

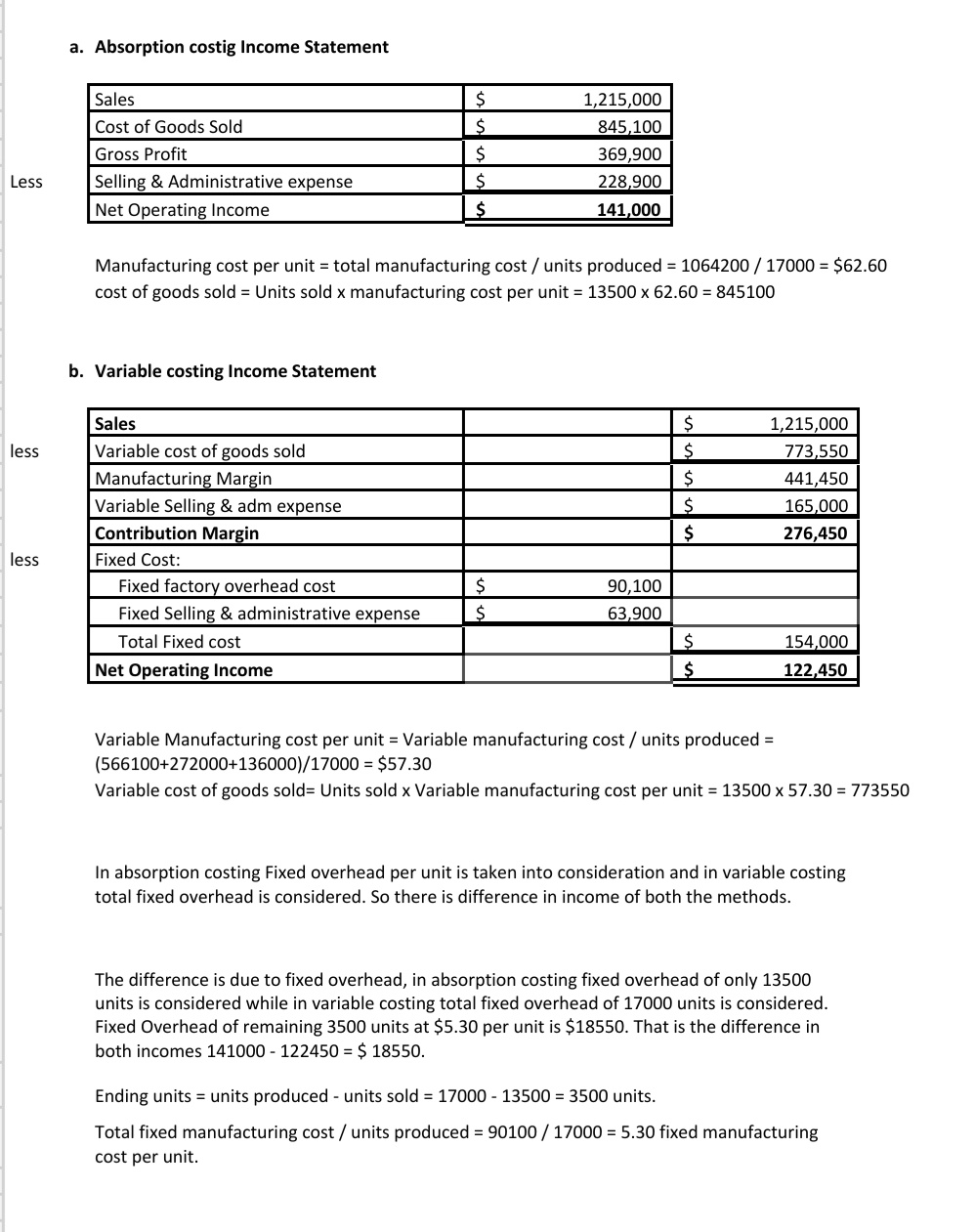

This method of costing is essential as per the accounting standards to produce an inventory valuation captured in an organization’s balance sheet. By allocating fixed costs to inventory, absorption costing provides period cost vs product cost period cost examples and formula video and lesson transcript a fuller assessment of profitability. If price per unit sold is $4.5, calculate net income under the absorption costing and reconcile it with variable costing net income which comes out to be $20,727.

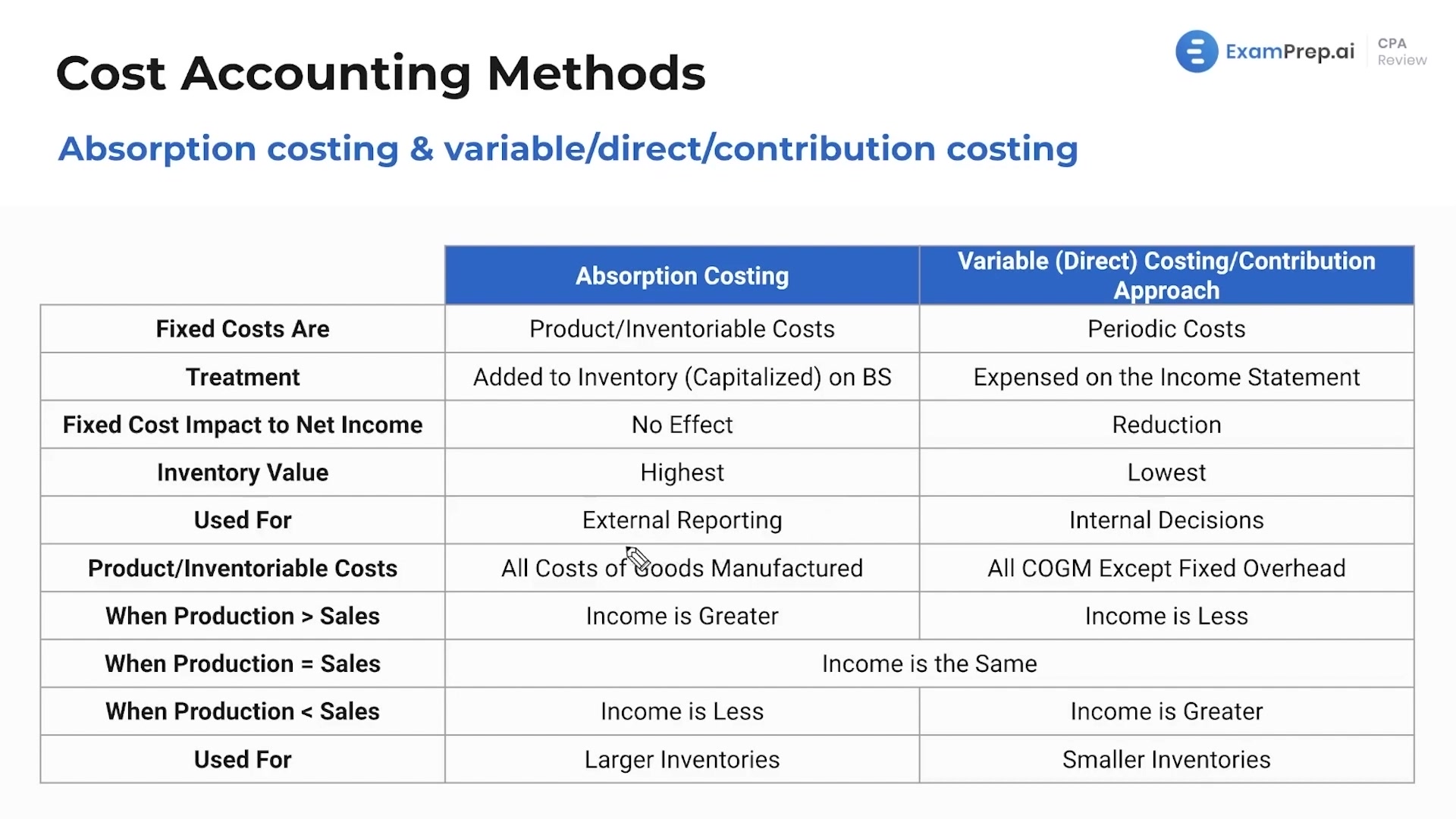

Absorption Costing vs. Variable Costing

Since 2014, she has helped over one million students succeed in their accounting classes.

Revenue Reporting in Absorption Costing

- Since more costs are capitalized into inventory under absorption costing, the cost of goods sold recognized on the income statement tends to be lower in periods of rising production or increasing inventory levels.

- It helps companies determine the full cost of producing a product or service.

- Therefore, fixed overhead will be allocated by $ 1.50 per working hour ($ 670,000/(300,000h+150,000h)).

- An ethical and evenhanded approach to providing clear and informative financial information regarding costing is the goal of the ethical accountant.

- Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively.

Let us understand the concept of absorption costing equation with the help of some suitable examples. Managers can manipulate income by changing the number of units produced Producing more products gives a higher income. Absorption costing results in a higher net income compared with variable costing. It identifies and combines all the production costs, whether Variable or Fixed. Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures. This usage measure can be divided into the cost pools, creating a cost rate per unit of activity.

To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Most companies use cost pools to represent accounts that are always used. It is very important to understand the concept of the AC formula because it helps a company determine the contribution margin of a product, which eventually helps in the break-even analysis. The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit. Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost. As you can see, by allocating all manufacturing costs to inventory, absorption costing provides a more comprehensive assessment of profitability.

Inventory Management with Absorption Costing

Using the absorption costing method on the income statement does not easily provide data for cost-volume-profit (CVP) computations. In the previous example, the fixed overhead cost per unit is \(\$1.20\) based on an activity of \(10,000\) units. If the company estimated \(12,000\) units, the fixed overhead cost per unit would decrease to \(\$1\) per unit.

Having a solid grasp of product and period costs makes this statement a lot easier to do. Calculate unit cost first as that is probably the hardest part of the statement. Once you have the unit cost, the rest of the statement if fairly straight forward. Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or regulatory agencies.

However, absorption costing depends heavily on cost estimates and output assumptions. In summary, absorption costing provides a comprehensive look at per unit costs by incorporating all expenses related to production. The tradeoff is that net profit fluctuates more than with variable costing methods. Understanding these basics helps explain the meaning and utility of absorption costing.

Absorption costing, also called full costing, is what you are used to under Generally Accepted Accounting Principles. Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs. Remember, total variable costs change proportionately with changes in total activity, while fixed costs do not change as activity levels change. These variable manufacturing costs are usually made up of direct materials, variable manufacturing overhead, and direct labor. The product costs (or cost of goods sold) would include direct materials, direct labor and overhead. The period costs would include selling, general and administrative costs.

Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced. Therefore, as production increases, net income naturally rises, because the fixed-cost portion of the cost of goods sold will decrease. The components of absorption costing include both direct costs and indirect costs. Direct costs are those costs that can be directly traced to a specific product or service. These costs include raw materials, labor, and any other direct expenses that are incurred in the production process.

However, it can result in over- or under-costing inventory if production volumes fluctuate. This is why under GAAP, financial statements need to follow an absorption costing system. By means of this technique to determine profits, no distinction is made between variable and fixed costs. As the absorption costing statement assumes that products have fixed costs, all manufacturing costs must be contained within the creation cost, whether variable or fixed. Absorption costing is an accounting method used to determine the full cost of producing a product or service.